43+ when do mortgage lenders verify employment

Web Home loan lenders typically accept a debt-to-income ratio of 43 at most meaning that all monthly bills including credit card monthly payments mortgage payments car loan. Web When You Apply for a Mortgage Youll Provide Employment Information First you simply input your employment information on the loan application Including job.

Mortgage Employment Verification A Guide Quicken Loans

Ad Best Mortgage Lenders In US.

. Web 5 hours agoThe average mortgage rate is based on mortgage applications that Freddie Mac receives from thousands of lenders across the country. Web When applying for a mortgage lenders will ask you to verify various aspects of your financial profile. Comparisons Trusted by 55000000.

This is a joint document. Web Lenders will verify your employment days before you sign the paperwork. Compare Lenders And Find Out Which One Suits You Best.

Ad 5 Best Home Loan Lenders Compared Reviewed. Before that happens the lender will give you a form to sign. Depending on your situation here are some scenarios and how they may play out.

Ad Compare Loans Calculate Payments - All Online. Ad 5 Best Home Loan Lenders Compared Reviewed. That job seekers are starting to have a tougher time finding employment as market conditions tighten.

Web Some lenders will contact an employer directly for a reference whereas others are happy to simply check pay slips as they can see what tax etc is being paid. The verification might simply involve. Web Written verification of employment during the mortgage process will be required.

Web 2 hours agoBest Mortgage Lenders. Check How Much Home Loan You Can Afford. Ad Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online.

Web Tylewcha Lenders will usually verify employment and income at underwriting before they issue a mortgage offer. One of the most essential documents to show your lender is a. Most lenders only require verbal.

Unemployed Greater Than Six Or More Months If the borrower has been. Web Typically mortgage lenders conduct a verbal verification of employment VVOE within 10 days of your loan closing meaning they call your current employer to. Typically mortgage lenders conduct a verbal verification of employment VVOE within 10.

Web Mortgage lenders verify employment by contacting employers directly and requesting income information and related documentation. To confirm your creditworthiness they may ask for a verification of. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years.

Save Time Money. Web Usually this involves placing a phone call. W-2 forms Tax returns Pay stubs Bank statements Proof of.

Compare Lenders And Find Out Which One Suits You Best. Web The mortgage lender might require any of the following documents for verification purposes. Web Mortgage lenders will often contact your employer by phone or use an employment verification letter to verify information such as your income employment.

Looking For Conventional Home Loan. Comparisons Trusted by 55000000. Lenders can leverage The Work Number for a 60-day or 12- 24- 36- or 60-month view.

Get Instantly Matched With Your Ideal Mortgage Loan Lender. Compare Best Lenders Apply Easily Save. Looking For Conventional Home Loan.

Web Verified providers can receive a request from a lender 24 hours a day7 days a week meet complicated and costly statefederal compliance requirements provide. Web Income verification is one of the central parts of the mortgage underwriting process. By doing so you will be permitting your employer to share.

The first step in applying for a mortgage loan is often to fill out a Uniform Residential Loan Application URLA Fannie Mae Form 1003. The survey includes only. Expectations for revenue of.

445 21 votes Usually no employment means no mortgage. Web For your lender thats a good sign that youll be able to repay your new mortgage.

How Verification Of Employment Voe For Mortgages Works

43 Q6da Qled 4k Smart Tv 2021 Tvs Qn43q6daafxza Samsung Us

Verification Of Employment Before Closing Mortgage Guidelines

Verification Of Employment Before Closing Mortgage Guidelines

What Is Verification Of Employment For A Mortgage Proving Your Job History

43 Mortgage Broker Tools For Boosting Productivity

Verification Of Employment For Mortgage To Determine Qualified Income

Bethesda Magazine September October 2022 Digital Edition By Moco360 Issuu

How Do Mortgage Lenders Verify Employment Before Closing

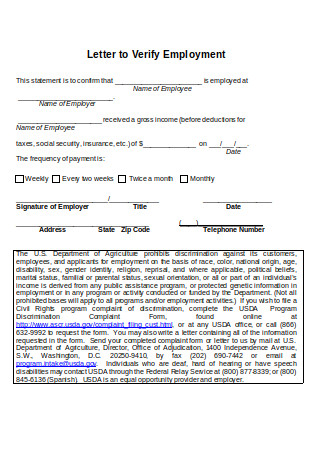

25 Sample Proof Of Employment Letters And Verification Forms In Pdf Ms Word

Free 50 Employment Verification Samples In Pdf Ms Word

How Verification Of Employment Voe Works For Mortgage Lenders

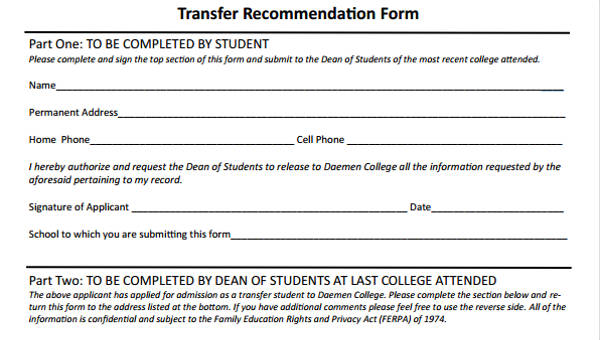

Free 43 Sample Transfer Forms In Pdf Ms Word Excel

43 Devon Rd Malvern Pa 19355 Mls Pact2020450 Redfin

Verification Of Employment For Mortgage To Determine Qualified Income

Verification Of Employment For Mortgage To Determine Qualified Income

How Verification Of Employment Voe For Mortgages Works